Augur Probability Markets

WITH ALL THE SPECULATION IN THE CRYPTOSPHERE, IT IS LIBERATING TO COME ACROSS A PLATFORM THAT YOU CAN USE, RIGHT HERE, RIGHT NOW. According to Ben Davidow, Augur is the world's first decentralized prediction market (DPN). It aims to unlock the wisdom of the masses by offering incentives for insider knowledge. Will Donald Trump win a second term as President?Ö that is a current question on Augur (probability: 40%). Will there be a big earthquake in Tokyo by April 2019? (probability: 2%.) The theory is, people with secret knowledge, for example Japanese seismologists, will try to exploit their private expertise, and tip off the market. Over time, Augur might answer some of our most profound questions, such as When will AI become self-aware? I am betting never... but with that kind of bet, there would never be a payday. That is the kind of market I am going to stay away from, for reasons that I will shortly explain. Augur has huge potential, not just in the speculated future, but right now, and that is what attracts me to the platform. That said, the system is still a bit buggy, very much Beta, and counterintuitive for newbies. To begin with, bets are called markets (buying and selling the probability of a certain event). If you want to bet against an event, you sell shares in it (even though you don't own any shares to begin with). Once you wrap your mind around this, it gets a little easier, but there are other problems. The UI can shut down, for days at a time. With some markets it can take a lot of time getting trades through. Cancelling such orders costs more gas (though not as much as it costs to enter or exit a market). Congestion on the Ethereum blockchain can freeze you just when you are about to pounce. In spite of these obstacles, I persist, because I can see real rewards here. Based on my experiences so far, I it is 93.75% sure that I have found the Holy Grail for bear markets such as these. And since my research has revealed that cryptocurrencies spend 75% of the time in a bear market, Augur offers me the way to monetize my downtime. Who knows, it could help kickstart the Escape from Oz, which has been languishing in my own bear market for far too long...CASE STUDY

IMAGINE IF today (October 26, 2018), I buy 1 share of a Democratic victory in the US Midterm elections. Currently, this one share is worth 0.57ETH. In other words, for 0.57ETH I can buy 1 share in the possibility of a Democratic victory. If the Democrats win, I will get 1ETH back. That's a potential gain of 0.43ETH (75%). If the Democrats lose, I lose my 0.57ETH (100%).Sounds interesting, but American politics isn't really my game. Let's try something else for this case study then. Ideally, I would like bets which expire soon, so that the Opportunity Cost is (OC) lower. Many of the markets on Augur concern cryptocurrency trading and this is an area I feel more comfortable with. I have several years of experience in this field, and I have developed my own theories. There are loads of bets for Ethereum and they seem strangely bullish. Will the price of Ethereum exceed US$300 at the end of 2018? 37% of people seem to think it will. It is worth noting that the current value of Ethereum is about $200. Both Bitcoin and Ethereum are in bear markets, and I believe they are both overdue for a slide. Yet, 37% of the money on Augur believes that Ethereum will grow 50% by the end of the year. This confidence feels misguided. I know, it sounds like I am being arrogant. Augur is supposed to be a snapshot of the hive mind, cultivated by the wisdom of the masses. But according to Augur, the Ethereum price is going up, and I believe it is heading down. One of us is wrong, and it sure as hell isn't me. If I jumped in and voted with the naysaying 63%, I figure, I could earn a pretty safe 58% profit, which would take 2.5 months or so to expire, and clear. Let's call it a 23% profit per month, if I win. Not bad, but I am sure I can find something better. Since I am a Uranian, I decide to go against the flow, and this happens to be the most lucrative way to bet. My attention focusses on a market titled "Will the Price of Ethereum Exceed $200 at the end of 2018?" The current odds are: 61.1% yes, 39.9% no. That's a 222% return if I win! Or in OC terms, 100% per month.

A few weeks after placing my bet, the Ethereum price collapsed, plunging all the way to $120 by November 24. So much for the wisdom of the masses. As Ethereum dropped, the value of my Augur shares increased, as the screen shot above confirms. The Augur web interface utilizes ipfs technology and reports your daily and monthly Profit/Loss count. So far, I seem to earning about 60% profit on my current investments! That is a 60% return, per month! Can I keep it up? Bear in mind: just one loss would involve the loss of everything I staked in that individual bet.

HEDGING AGAINST CROWD LOGIC

ANOTHER OPPORTUNITY offered by Augur is hedging. During bear markets, traders could bet on falling prices, and still make money. Residents of Tokyo could insure themselves against future earthquakes. Australian farmers could hedge against droughts, instead of expecting the Government to bail them out, as they usually do. For the last month of 2018, I expect the value of ETH value to fluctuate between US$75 and $150. Now, there is a market available which asks the question: "Will the Price of Ethereum Exceed 100 USD at the End of 2018". A few days ago, I saw odds of 50% for this possibility, which I thought were a trifle pessimistic. Ethereum has already fallen nearly 50% in the past month, and it is oversold in my opinion. While this is definitely a bear market, Ethereum has copped quite a beating, and I can't imagine it getting beaten any further down. I decide to ignore the wisdom of the crowds, and bet on Ethereum exceeding $100 at the end of 2018. I buy 0.2 shares in this event, for the princely sum of 0.1ETH. At the current time, that is about US$12. It is not much I know, but let's run with that. If I win, I get $24, and if I lose, I lose $12. Shortly thereafter, ETH began to decline, falling to just over $100. I was fairly relaxed, since these fluctuations are to be expected. l as the 0.065ETH initially staked. However, I would lose the 0d against this eventuality. Thus, I would suffer a loss of 0.0325ETH. On the other hand, if ETH fails to reach $100, I will lose my 0.065ETH bet, but make a 0.1405ETH profit., for a 0.13ETH/1 month opportunity cost. In other words, a profit of 25% per month. Then, around December 5, Ethereum dipped again, this time all the way to $85. I was worried. I guess I have won so often lately, I can afford to lose. if the Ethereum.#Ethereum Price: USD $129.44 $ETH https://t.co/fEmlFYBpqp pic.twitter.com/puLcJpvwqa

— Brave New Coin (@bravenewcoin) December 23, 2018

Unveiling Scalar Markets

COOL AS Augur is, it is only the start. Veil is an app built atop the Augur protocol. Veil uses the 0x token as well as Augur to facilitate trades, speeding up the payout process dramatically. You need to register to use it, but the user experience is far superior to Augur.There appears to be a bet every week, focusing on Bitcoin, REP and Ripple. There are less bets available, but more action taking place in each market. That makes it like Augur on speed, to be honest. ... It features scalar markets, in which you can win more if your bet is closer to the final result... If Bitcoin is bouncing on the bottom, then I would expect that the price of Bitcoin is more likely to rise, than drop. Despite Bitcoin being at the bottom (on January 19, 2019) at US$3660, Veil has 45% odds of a further drop, and a 55% chance of a rise. Allow to reiterate: I believe that Bitcoin is as low as it can possibly go. It can go lower, but it is not likely.

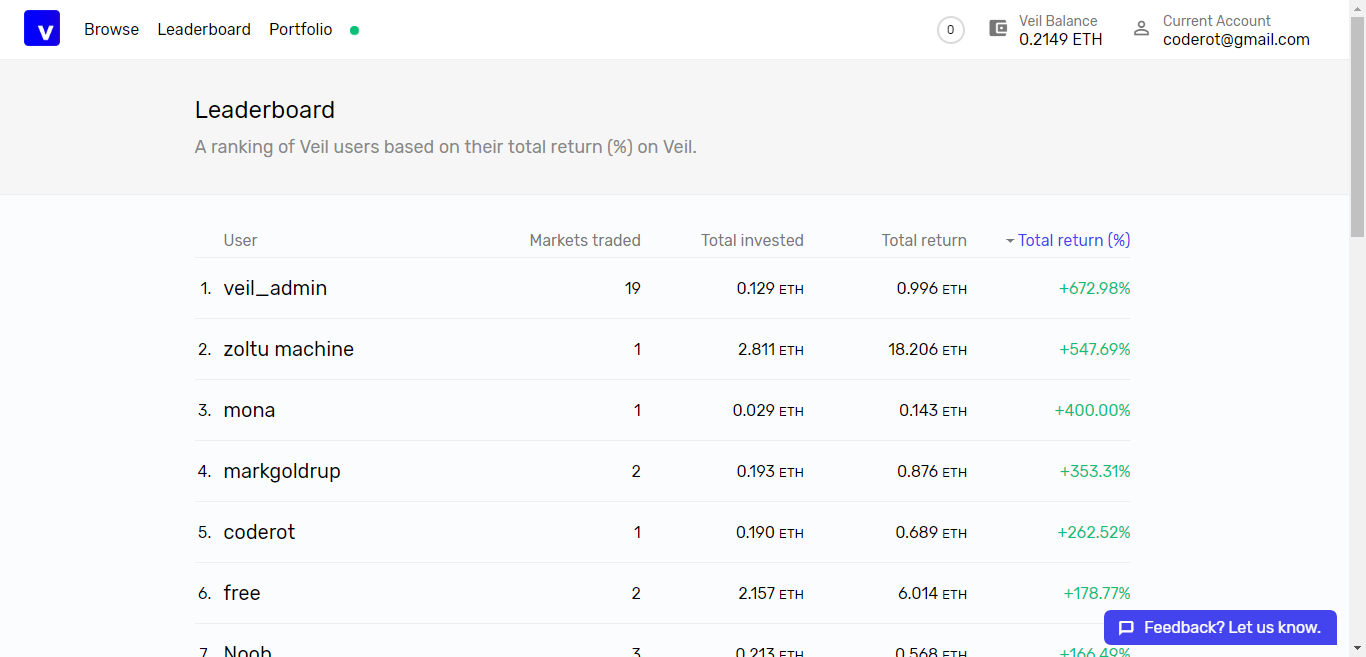

I made it on the leaderboard! Debuting at number 5, with a bullet! Not bad, but I think I was lucky this time. It is possible that volume could be the limiting factor. ensure they correctly report the outcomes. I made the mistake of entering a market with a

Social Trading

SOCIAL TRADING is otherwise known as shadowing. On Explore Augur you can see the leaderboard of all the people who are doing well on the platform. To shadow well, one needs to follow an active trader. (0.7% chance). Obviously he or she must have a special talent for trading! He or she has been right more than 99% of the time. So far, zoltu_machine has been earning US$250 a day on Veil."Poyo, a pseudonymous individual, was one of the major players in the Democrats v Republicans debate in Augur where a market on who will control the house after the mid-term elections had an expiry date set prior to Democrats actually taking control..." https://t.co/oWGfkkYH76

— Robert Sullivan (@robsullivan1973) March 24, 2019

» Explore Augur

» Generational Dynamics (Forecasting America's Destiny... & the World's

» Guesser

» Predictions Global

» Reddit (Augur Thread)

» Reporters Chat